Section 80-IAC of the Income Tax Exemption Act, 1961, which was enacted on April 1, 2017, offers a full 100% tax deduction on profits to eligible taxpayers for three consecutive years. It greatly benefits the businesses during these three years by giving them much-needed relief in taxes.

The income tax benefit accrues under Section 80-IAC of the Income Tax Act of 1961 to eligible start-ups. The start-up can be either a company or an LLP, which shall focus on innovative and scalable ideas. A 100% profit deduction claim stands for them on qualifying activities. To be qualified, the business should involve innovation, improve their products and services, and can be expected to generate a lot of job and wealth opportunities.

What are the Tax Exemptions for Startups?

The Indian government has come up with a series of tax exemptions to facilitate the Startup India and Make in India initiatives. These exemptions will help ease significant financial burdens from the shoulders of startups, and facilitate innovation and entrepreneurship in the country. Through reduced tax burdens, the government intends to create a better environment for these emerging businesses to soar.

1. A Tax Holiday of 3 Years

This benefit can be claimed by any startup registered or incorporated between April 1, 2016, and March 31, 2022. In the case of such startups, their profits will be 100% tax exempted for three years. But the company’s total turnover in any financial year must not exceed 25 crores. Lack of funding is one of the major issues of a startup. The three-year tax holiday facilitates the setting up of the business of these startups easily.

2. Exemption on Long-term Capital Gains

A new provision called Section 54EE provides an Income tax exemption for long-term capital gains. This rule allows eligible startups to avoid long-term capital gains tax if the gains are invested in a government-specified fund within six months of selling the asset. The maximum amount that can be invested is 50 lakh rupees, and the investment must remain in the fund for three years. If any withdrawal from the fund is realized before completing three years, the tax exemption would be null and void.

3. Exemption on Investments Above FMV

This implies that startups do not pay taxes on investments exceeding the fair market value of the company. Investments from angel investors, incubators, and even persons or funds that are not registered venture capital funds, fall into this category.

In simple terms, if angel investors invest more than the company’s assessed value, that investment will not be subject to taxation. This allows startups to retain more funds for their operations.

4. Tax Exemption Under Section 54GB

According to section 54GB of the Income Tax Act. It states if any individual and Hindu Undivided Family sells their residential houses, and these sale proceeds are utilized to invest SMEs or investment 50 per cent or above the share of an eligible start-up, in which case income tax on a long-term capital gain will be exempted. This exemption, however, applies only if the shares are not sold for five years from the date of acquisition. Further, the startups should use the invested amount for buying assets and sell or transfer those assets within five years of their purchase.

5. Set-off of Carry Forward Losses Allowed

Section 79 of the Income Tax Act specifies when a company may carry forward losses if all these conditions are satisfied. Specifically:

1. Shareholders holding shares in the company having voting power when the loss occurred should retain such shares up to March 31 of the year the company seeks to carry forward such loss.

2. The loss must have been incurred within seven years of the incorporation of the company.

If you are a startup owner and wish to know more about your tax liabilities, you can hire a Chartered Accountant (CA). They will be able to guide you on financial matters and help you file your income tax return, thereby maximizing your tax savings.

Eligibility Criteria for Section 80IAC Tax Exemption

The eligibility criteria for obtaining an Income tax exemption under Section 80IAC are detailed below:

1. Type of Business: Your startup must be a Company, Limited Liability Partnership (LLP), or a registered partnership firm. Other business types are not eligible for this deduction.

2. DPIIT Recognition: You must be recognised by the Department of Promotion of Industry and Internal Trade and have a DPIIT Recognition Certificate.

3. Incorporation Date: Your startup must be incorporated or registered between April 1, 2016, and March 31, 2025, to qualify.

4. Age of Startup: You can claim the deduction within the first 10 years from the date of incorporation.

5. Business Formation: Your startup must not be created by splitting up or reconstructing an existing business, except for certain cases mentioned under section 33B of the Income Tax Act.

6. Equipment: You must use new plant and machinery, not equipment that has been transferred from an existing business.

7. Turnover Limit: Your startup’s turnover must not exceed Rs. 100 crores in the financial year for which you are claiming the deduction.

8. Business Goal: The main goal of your startup should be to create jobs, generate wealth, and promote financial growth.

9. Innovation: Your startup should focus on developing new products, services, or processes, or making significant improvements to what already exists. Startups created by splitting or reconstructing existing businesses do not qualify for DPIIT Startup Tax Benefits.

How to Apply for Exemption under Section 80-IAC?

To claim the deduction under Section 80-IAC, the eligible assessed must apply for the certificate from the Inter-Ministerial Board of Certification. The following are the steps involved in applying for the certificate:

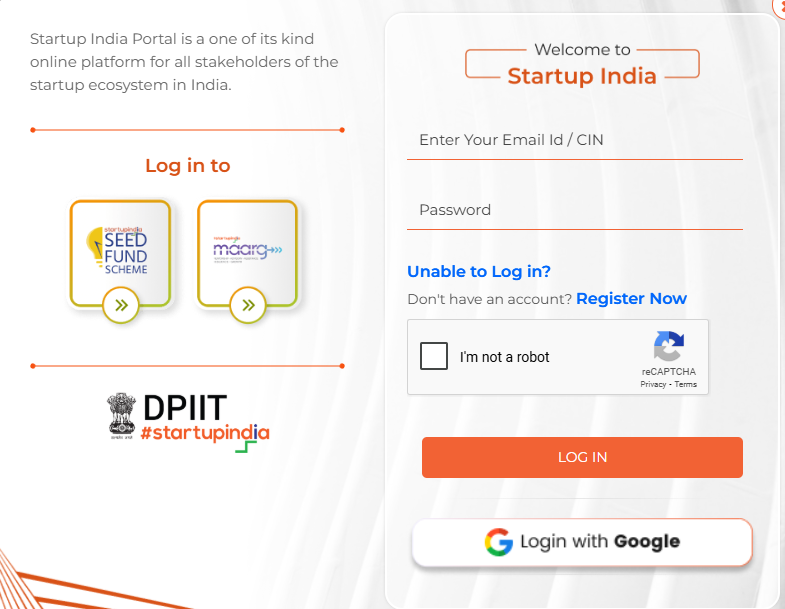

Step 1: Log in to the Startup India portal

Then, apply for the DPIIT recognition certificate by following the steps shown on the screen during the Startup India registration process.

Step 2: Choose claim Income tax exemption

Fill out the form with the following details:

- Name of the startup

- Date of incorporation

- Address and business location

- Incorporation/registration number

- Nature of business (LLP or PLC)

- DIPP number

- Contact information (E-mail ID, phone number, and PAN number of the entity)

Step 3: Submit Documents

If a startup needs income tax deductions, it must submit these documents in PDF format:

- Limited Liability Partnership Deed (for LLP)

- Memorandum of Association (for PLC)

- Board Resolution (if any)

- CA-certified balance sheet and Profit and Loss statements

- Financial Statements for the last three years or since the date of establishment

- Income Tax Returns for the last three years or from the date of establishment

- Link to a video pitch of the startup

- Pitch Deck in PDF format

Note: If a startup has an angel tax exemption certificate, it must also provide the relevant details.

Benefits of Section 80-IAC

The benefits of Section 80-IAC of the Income Tax Act, of 1961, include the following:

1. 100% Deduction on Profits and Gains: Startups can deduct all of their profits and gains from qualified businesses for three years.

2. No Advance Tax Required: Eligible startups don’t have to pay advance tax since they have no tax liability under this provision.

3. Reduction in Taxable Income: The deductions help startups lower their tax burden during their early stages. This reduction in taxable income allows them to use their resources more effectively.

4. Simplified Application Process: Startups can easily apply for these deductions online without any government fees. The simple process encourages more startups to take advantage of this tax exemption.

Conclusion

Section 80-IAC of the Income Tax Act Exemption, 1961 is one of the most important benefits offered to eligible startup organizations. The section encourages businesses to come up with innovative new products and services. These start-ups get financial support so that they may be stable and innovative. Besides this, it highly supports the Indian entrepreneurial ecosystem.

Also Read: SaaS Companies in India | Successful Startups of India | Edtech Companies in India

FAQ’s

1. What is section 80-IAC of the Income Tax Act?

Section 80-IAC offers a benefit from the Central government for eligible startups. It allows them to deduct 100% of their profits and gains from qualifying businesses when calculating their taxes.

2. How long does it take to get approval for the section 80 IAC tax exemption?

After you submit the form for the section 80-IAC tax exemption, you will wait for approval. The income tax department will check all the information and documents you submitted. The approval process from the DPIIT usually takes about 3 to 9 months. You can track your application for the 80-IAC tax exemption by visiting the Startup India portal and going to the ‘Dashboard’ tab in your profile.