Pradhan Mantri Mudra Yojana is a government scheme introduced by the Prime minister to empower small entrepreneurs belonging to non-corporate, non-farm, and small/ micro enterprises through financial support. Under this scheme, up to Rs. 20 Lakh loans are provided to entrepreneurs, categorized as Mudra Loans by the Commercial Banks, RRBs, Small Finance Banks, MFIs, and NBFCs. Facilitating startups to flourish their business, launching this scheme is a powerful step taken by the government to assist them monetarily.

| PM MUDRA Yojana | |

| Particulars | Details |

| Introduced on | 08th April, 2015 |

| Ministry/ Department | Ministry of Finance |

| Head Office | Bombay, Maharashtra |

| Loans | Shishu (loans up to INR 50,000), Kishore (loans from INR 50,000 up to INR 5 lakhs), Tarun (loans from INR 5 lakhs up to INR 10 lakhs), Tarun Plus(Loans above Rs. 10 Lakh up to Rs. 20 Lakh) |

| Parent organization | Small Industries Development Bank of India (SIDBI) |

| Chairman & Managing Director | Shri S. Ramann |

| Banks providing PMMY Loans | Oriental Bank of Commerce, ICICI Bank, Kotak Mahindra Bank, Standard Chartered Bank, Indian Bank |

If you want to know more about this scheme, get into this blog to get comprehensive information about Pradhan Mantri Mudra Yojana, including its benefits, loan amount, eligibility criteria, Pradhan Mantri Mudra Yojana application form-filling process, etc.

Pradhan Mantri Mudra Yojana: Financial Assistance to Small Entrepreneurs

| Financial Year | No. of PMMY Loans Sanctioned | Amount Sanctioned (in Crore) | Amount Disbursed (in Crore) |

|---|---|---|---|

| 2023-2024 | 66,777,013 | 541,012.86 | 532,358.35 |

Launched on April 8, 2015, by Indian Prime Minister, Pradhan Mantri Mudra Yojana enables small entrepreneurs to avail of loans up to 20 Lakh, provided by Commercial Banks, RRBs, Small Finance Banks, MFIs, and NBFCs. The beneficiaries of the scheme include micro-enterprises engaged in the non-corporate and nonfarm sectors in manufacturing, trading, or service sectors including activities allied to agriculture such as poultry, dairy, beekeeping, etc.

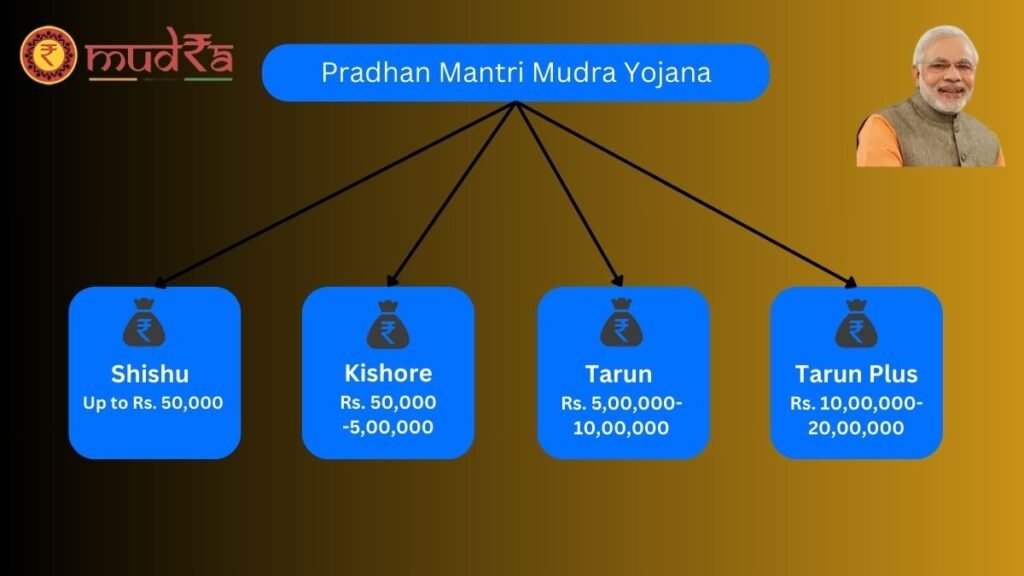

There are four products, ‘Shishu’, ‘Kishore’, ‘Tarun’, and ‘TarunPlus’ are provided under the scheme based upon the level of growth/development, funding requirements of the beneficiary and also communicate the reference point for the next level of growth.

In the micro and small entities, many proprietorship/partnership firms run as small manufacturing units, service sector units, shopkeepers, fruits/vegetable vendors, truck operators, food-service units, repair shops, machine operators, small industries, artisans, food processors, etc. are included. Those who are interested and eligible can apply for the scheme on the portal www.udyamimitra.in.

Prime Objectives of Pradhan Mantri Mudra Yojana

The main objectives of launching Pradhan Mantri Mudra Yojana are mentioned below:

- Financial assistance: By sanctioning loans up to rupees 20 Lakhs, it aims to provide financial assistance to entrepreneurs having a business plan to generate income from a non-farm activity like manufacturing, processing, trading, or service sector, etc.

- Economic growth: Through credit support, it generates employment opportunities and thus expands the overall GDP by helping micro-enterprises to grow and thrive.

- Regulation of MFIs: MUDRA loan facilitates the monitoring of the network of microfinance institutions, thus ensuring transparency aspects.

- Financial inclusion: By helping small businesses financially, it caters to the aspect of financial inclusion, creating opportunities for low-income entrepreneurs to expand and flourish.

Categories of PMMY Loans

PMMY Loans are categorized into different heads, known as Shishu, Kishore, Tarunand Tarun plus. This categorization is made based on the development stage and funding requirements of entrepreneur beneficiaries.

| Loan categories | Loan coverage |

| Shishu | < ₹50,000 |

| Kishor | Above ₹50,000 up to ₹5,00,000 |

| Tarun | Above ₹5,00,000 up to ₹10,00,000 |

| Tarun Plus | Above ₹10,00,000 up to ₹20,00,000 |

- Shishu: This category is created for entrepreneurs who are at the initial stage of starting a business and need funds to fulfill their financial requirements. Under the Shishu category, they get credit support up to INR 50,000.

- Kishor: This lending option is curated for micro or small businesses that require more finances to advance their infrastructure or meet production needs. It has an upper limit of up to INR 5 lakhs.

- Tarun: It enables entrepreneurs belonging to small and medium-sized enterprises to avail of the maximum loan amount of up to INR 10 lakhs. Thus, it is beneficial in meeting startup funding requirements.

- Tarun Plus: Under this category, Individuals get Credit support of ₹10,00,000 up to ₹20,00,000 for fulfilling their business needs.

Note: The interest rates on the loans will be fixed as per the RBI guidelines and updated from time to time.

Eligibility Criteria of Pradhan Mantri Mudra Yojana

To apply for Pradhan Mantri Mudra Yojana, applicants are required to fulfill the Mudra loan eligibility criteria that are listed below:

- The applicant must be an Indian citizen.

- A borrower who is an individual or belongs to a Proprietary concern, Partnership firm, Private Limited Company, Public Company, or entities of any other legal form is eligible.

- The applicant must have a business in a Non-Farming Sector with income-generating activities such as Manufacturing, Processing, Trade, Service Sector, or other fields and have a loan requirement that does not exceed ₹10 lakhs.

- The applicant must be engaged in any of the below-mentioned business fields:

- Micro and Small enterprises, including the Trading, Manufacturing, and Service sectors.

- Shopkeepers

- Fruit and Vegetable vendors

- Artisans

- Activities allied to agriculture, e.g. poultry, livestock, pisciculture, beekeeping, sorting, aggregation agro industries, rearing, grading, diary, fishery, agri clinics, agribusiness centers, food & agro-processing, etc. (not involving crop loans, land improvements, including irrigation, canal, and wells).

- To avail of the Tarun Plus loan (Loan from Rs. 10 Lakh to Rs. 20 Lakh), Individuals are required to repay the regular Tarun loan amount up to Rs 10 lakh.

How to Apply for Pradhan Mantri Mudra loan

To apply for Pradhan Mantri Mudra Yojana to avail scheme benefits, applicants are required to follow the “Pradhan Mantri Mudra Yojana online apply” Process listed below:

- Firstly, click on this link https://www.mudra.org.in/ to open the official website.

- After getting into the official website, scroll down and find different options such as Shishu, Kishore, Tarun, and Tarun Plus.

- Click on any of the preferred categories and proceed to the next page.

- Here, you will find different links under the PMMY kit. Tap on the second link “Application Form for Shishu” to open the application form.

- Enter all the required details and submit the form to the bank such as Bank of Baroda, SBI, etc. from where you will obtain the loan.

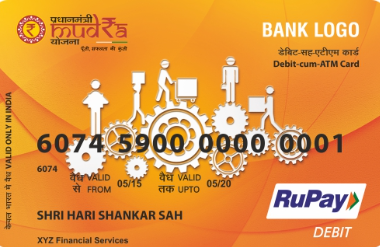

MUDRA Card: Seamless Cash Withdrawal

Mudra Card is a RuPay debit card that allows borrowers to get credit seamlessly and flexibly through the facility of working capital arrangement. Issued against the MUDRA Loan account, this card can be utilized by individuals in multiple drawls and credits, thus enabling them to manage the working capital limit effectively with less interest. Additionally, this card helps in digitizing MUDRA transactions and also prepares the credit history. It can be used in any ATM/micro ATM available in the country to withdraw cash and also they can make payments through Point of Sales machines.

Required Documents for Pradhan Mantri Mudra Yojana

1) Shishu Loan:

- Proof of Identity – Self-attested copy of Voter’s ID Card / Driving Licence / PAN Card / Aadhaar Card / Passport / Photo ID issued by Govt. authority etc.

- Residential proof – recent telephone bill/electricity bill/property tax receipt (not older than 2 months) / Voter’s ID Card / Aadhar Card / Passport etc.

- Recent Photos (2 copies) not older than 6 months.

- Quotation of Machinery / other items need to be bought

- Supplier name/machinery details/machinery price and/or items to be purchased.

- Identity proof/enterprise’s address – Copies of relevant licenses / Registration Certificates / Other Documents related to the ownership, identity of the address of the business unit, if any.

2) Kishore, Tarun and Tarun Plus Loan

- Identity proof- Self-attested copy of Voter’s ID card / Driving License / PAN Card / Aadhar Card/Passport.

- Residential proof – Recent telephone bill, electricity bill, property tax receipt (not older than 2 months), Voter’s ID card, Aadhar Card, etc.

- Two copies of recent colored Photos not older than 6 months.

- Identity Proof /Address of the enterprise -Copies of relevant licenses/registration certificates/other documents related to the ownership, identity, and address of the business unit.

- Statement of accounts (for the last six months)

- Last two years’ balance sheets of the units, income tax/sales tax return, etc. (Applicable for all cases from Rs.2 Lacs and more).

- Annual Projected balance sheets in case of working capital limits and for the period of the loan in case of term loan (Applicable for all cases from Rs.2 Lacs and above).

- Gained sales during the current financial year up to the application submission date.

- Project report (for the proposed project) including technical & economic viability-related details.

- Memorandum and Articles related to the association of company/partnership deed of partners etc.

- In the absence of a third-party guarantee, an asset & liability statement from the borrower including directors & partners may be required to know the details about net worth.

MUDRA Loan Beneficiaries

The primary objective of MUDRA loans is to enable small and medium-sized enterprises monetarily and boost the entrepreneurial environment in the country:

- Traders, shopkeepers, and vendors, with loan requirements of up to INR 10 lakhs per borrower/enterprise.

- Equipment finance for micro-units to purchase the essential equipment/machinery, with loan amounts up to INR 10 lakhs.

- Agriculture-related non-farm income-generating activities such as pisciculture, poultry farming, dairy, food, agro-processing, etc.

- Transport vehicle loans (commercial use only), including 3-wheelers, e-rickshaws, taxis, etc., and two-wheelers (commercial purpose) etc.

- Social, personal, and community service activities covering salons, dry cleaning, motorcycle repair shops, tailoring shops, courier agents, medicine shops, etc.

- Textile sector support, activities such as chikan work, zari, zardozi, cotton ginning, computerized embroidery, knitting, etc.

Prominent Banks Providing MUDRA Loans

Among associated public sector, private sector, regional rural banks, etc, here we are providing you a list of prominent banks of all categories, providing loans under PMMY with interest rates varying from 11% to 37%.

- Oriental Bank of Commerce

- ICICI Bank

- Kotak Mahindra Bank

- Standard Chartered Bank

- Indian Bank

- State Bank of Patiala

- Bank of India

- Central Bank of India

- IDBI Bank

- Citibank

Challenges for Pradhan Mantri Mudra Yojana

There are a few of the downsides associated with the Pradhan Mantri Mudra Yojana that are covered below:

- Approved amount: The Cumulative number of accounts and the amount approved for the Northeast region (2015 – 2022) is low at ~4% and diminishing after FY-2018.

- NPA: From financial year 17 to Financial Year 22, NPA accounts & amounts are expanding after each year with a compound annual growth rate (CAGR) of 22.51 % & 36.61 %.

- Public sector banks comprise the highest NPA of 22.6 % and NBFCs are estimated to have the lowest NPA of 1.3 %.

- The highest NPA is reported in Kishore accounts and the lowest NPA in the case of Shishu accounts.

- Design and claim settlement process:

- 15% limit on payout under CGFMU (the maximum amount the CGFMU is willing to cover for a defaulted loan) is a limitation.

- The claim settlement procedure is lengthy and strenuous under CGFMU. Including XML format, high uploading time, etc.

- Issues such as high guarantee fees, refinancing rates, and security problems due to lack of collateral.

- Credit penetration issues for weaker categories.

- Technical issues:

- No effective centralized database to compile the data.

- Lack of online feature resolving users’ queries related to the scheme.

Also Read: DPIIT Recognition for Startups | Income tax exemption for startups

FAQs

1. What is the Pradhan Mantri Mudra Yojana?

Pradhan Mantri Mudra Yojana is initiated by the Prime minister to provide monetary support to small and medium enterprises to fulfill their various business needs, including infrastructure, resources, technology, etc.

2. What are the objectives of the MUDRA Yojana?

The main objective of the MUDRA yojana is to equip micro-businesses with the required finances by providing them loans up to Rs. 20 Lakh, helping them to grow and sustain their business.

3. Who is eligible for a Mudra loan?

A person who is an Indian citizen and owns a business in any of the fields among Manufacturing, Processing, Trade, Service Sector, etc., and has a loan requirement of less than ₹20 lakhs.

4. What is the limit of Mudra Yojana?

Initially when the Mudra Yojana was launched, its limit was Rs. 10 Lakh. However, on 23rd July 2024 in the Union Budget 2024-25, the limit was increased from the current Rs. 10 lakh to Rs. 20 lakh.

5. What are the loan categories under Mudra Yojana?

The loan categories under Mudra Yojana include Shishu (loans up to INR 50,000), Kishore (loans from INR 50,000 up to INR 5 lakhs), Tarun (loans from INR 5 lakhs up to INR 10 lakhs) and Tarun Plus (loans from INR 10 Lakhs up to INR 20 Lakhs).